ARMCOR SOLUTIONS Where Financial Clarity Meets Long-Term Security.

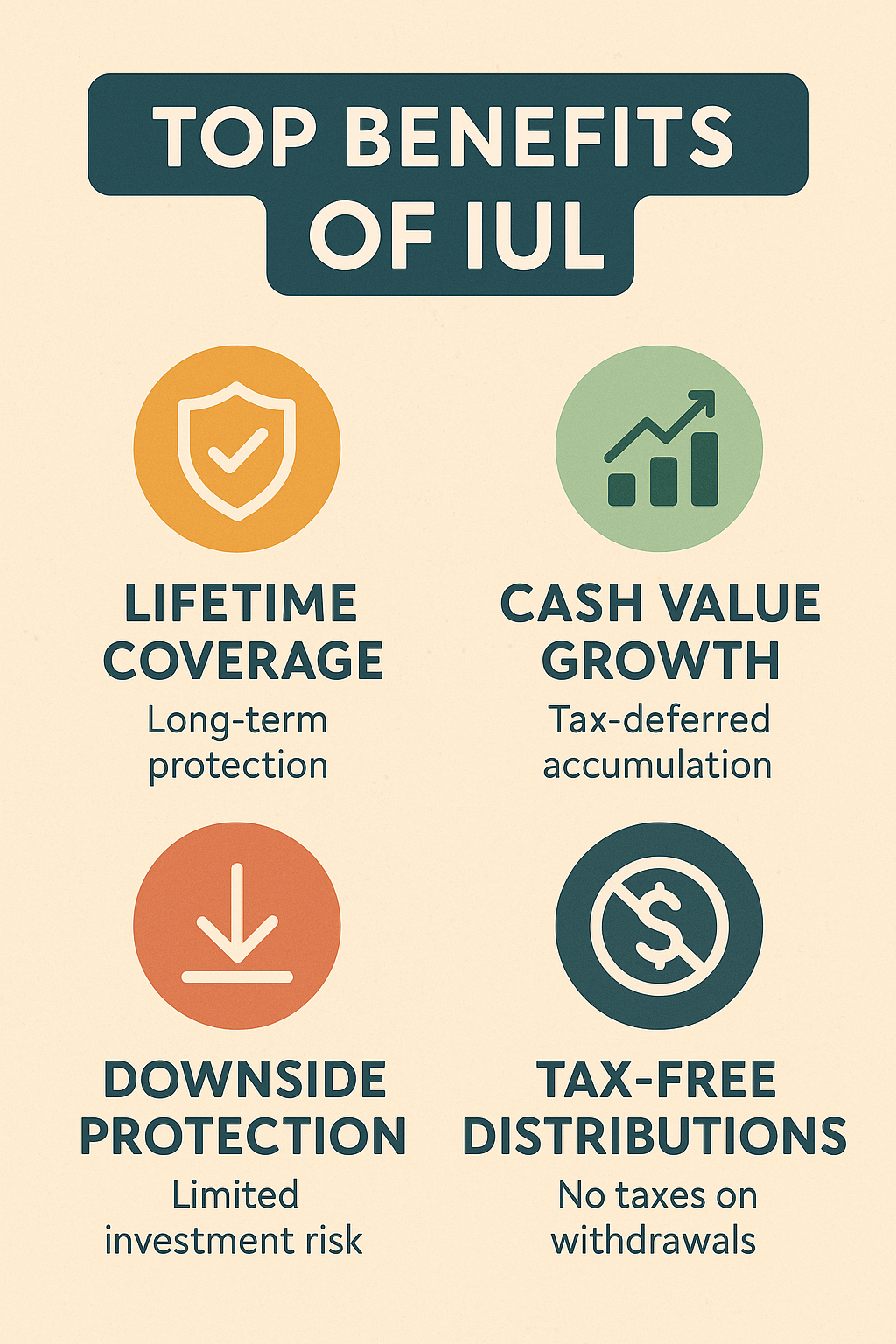

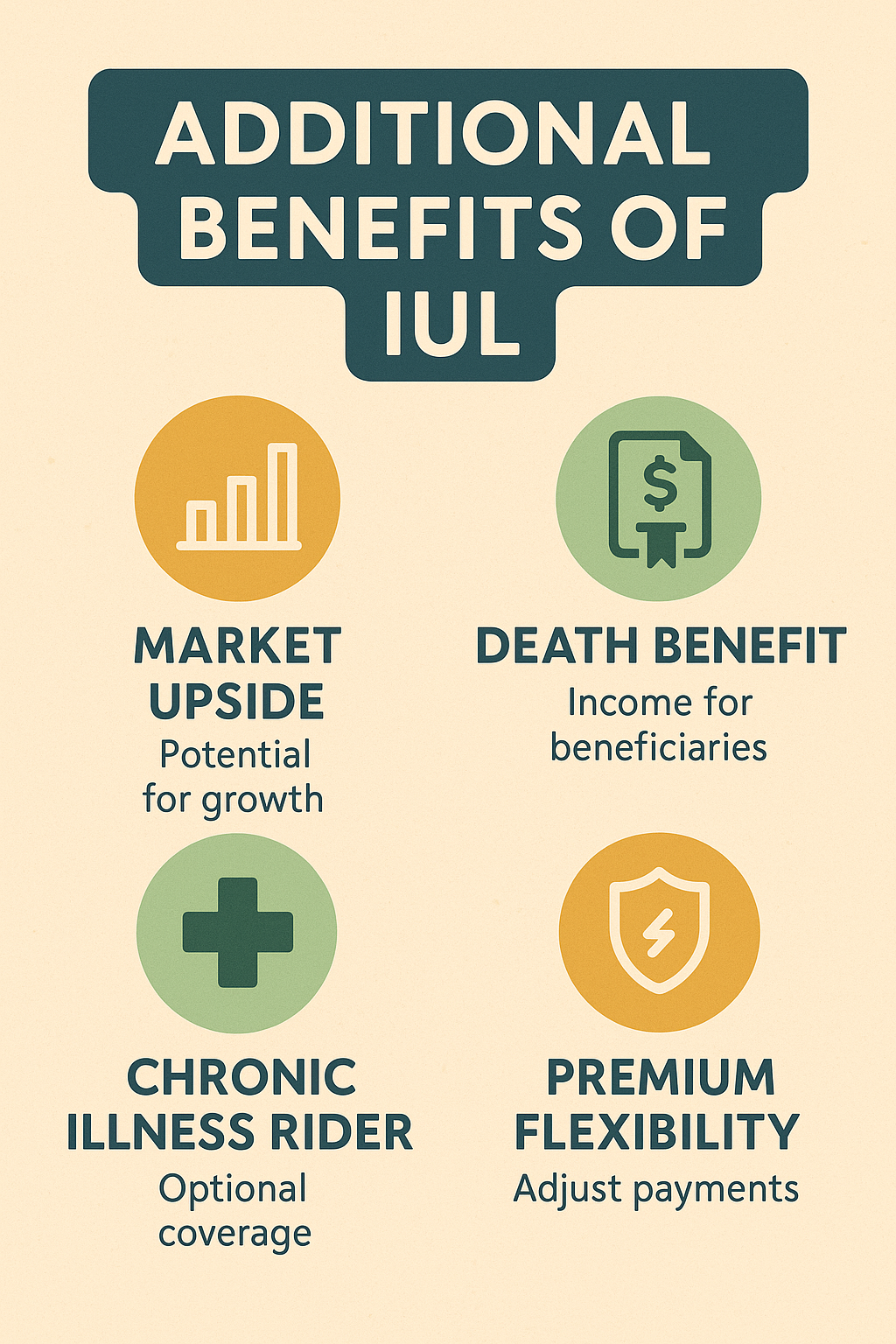

At ARMCOR SOLUTIONS, our mission is to empower families and individuals with financial strategies that are transparent, ethical, and designed for long-term success. We specialize in properly structured Indexed Universal Life (IUL) policies that maximize growth, minimize cost, and protect your legacy — without hidden agendas or commission-driven setups.

Retirement Solutions

Retirement should be a time of peace, not financial struggle. We guide you in choosing the best retirement options, including tax-free growth accounts, ensuring your golden years are truly golden.

College Funding

No parent wants to compromise the quality of their children’s education, yet tuition costs continue to rise. Whether you’re preparing to send your first - or fifth - child to college, I am here to share useful tactics on how to effectively support your children’s future while still saving for yours.

Tax-Free Growth Strategies

Why pay more in taxes when you don’t have to? Discover strategies that allow your money to grow tax-free, keeping more of your hard-earned wealth working for you and your family. Your wealth is more than just numbers; it’s a tool for long-term financial security. Learn how to shield your assets from unnecessary taxation, inflation, and poor investment choices while keeping them safe for future generations.

Legacy Strategies

Without a personal legacy strategy, the value of your estate can be eroded by taxes and assets may be dispersed in unintended ways. We can work with your attorney and tax professional to fund legacy strategies that can include life insurance products to keep your loved ones secure long after you're gone.

Lawsuit And Bankruptcy Protection

Financial risks can come unexpectedly. Learn how to legally and ethically protect yourself from lawsuits and bankruptcy, ensuring that your financial foundation remains unshaken.

Business Strategies

A good man leaves an inheritance to his children's children. Inheritance isn’t just about wealth—it’s about wisdom, education, and stewardship. Through our educational programs and personalized financial strategies, we help people leave a legacy of financial stability for future generations.

CALL TO ACTION

🚨 Don’t Let a Bad IUL Design Cost You Thousands.

Over 80% of Indexed Universal Life (IUL) policies are set up to benefit the agent — not you. Whether you’re planning to get a policy or already have one, make sure it’s built to protect your family and your future, not to pad someone else’s commission.

🔍 Already Have a Policy?

Let us review it — at no cost. We’ll check for hidden fees, wrong premium structures, poor cash value growth, and more.

🛡️ Looking to Get a New IUL?

We’ll design it the right way — fully transparent, max-funded, low-cost, and structured to build wealth and legacy.

Design Your Wealth. Defend Your Legacy. Smart IUL Strategies That Work For You — Not Your Agent

At ARMCOR SOLUTIONS, our mission is to empower families and individuals with financial strategies that are transparent, ethical, and designed for long-term success. We specialize in properly structured Indexed Universal Life (IUL) policies that maximize growth, minimize cost, and protect your legacy — without hidden agendas or commission-driven setups

6 major red flags to watch for so you don’t get taken advantage of by an IUL agent

1. Target Premium Is Set Too High

If your agent pushes for a high monthly/annual Target premium that’s a red flag.

Many greedy agents inflate the premium to increase their commission.

What to watch for: Ask about your minimum funded premium (MEC limit) and guideline level premium.

💸 2. Low Early Cash Value / Slow Growth

If your policy has no cash value in the first years, it is overloaded with insurance costs.

What to check: Ask for the cash surrender value vs. your total premiums paid in years 2–5.

📉 3. Cost of Insurance (COI) Not Explained

The COI silently eats up your cash value if not managed properly.

Many agents ignore this to make the policy look profitable on paper.

What to check: Ask your agent to break down the COI over time and how it’s being controlled.

⏳ 4. You’re Told You’ll Pay Premiums Forever

-

A well-structured IUL is designed so you don’t pay premiums for life.

-

If your agent doesn’t have a plan for premium offset or paid-up strategy, your policy may be flawed.

-

What to ask: “When do I stop paying, and how is that built into the design?”

5. Lack of Transparency & Education

-

If your agent doesn’t explain the policy components or uses buzzwords to confuse you, they’re hiding something.

-

What to expect: Full transparency, clear projections, access to your illustration, and answers to every question you ask.

6. No Discussion of Overfunding or Max-Funding Strategy

If your agent doesn’t talk about overfunding your IUL to reduce insurance costs and increase cash value, they’re likely prioritizing commissions over your future.

Overfunding allows more money to go toward growing your cash value, not paying the insurance company.

What to ask: “How close is this policy funded to the MEC limit?” and “Am I maximizing the tax-advantaged growth potential?”

HOW WE HELP

Your faith should guide every aspect of your life including your financial future. Let us help you navigate today’s financial landscape while remaining rooted in biblical principles.

Financial Education

Apply wisdom to wealth management and financial decision-making.Gain financial knowledge to make informed decisions about wealth-building and protection.

Retirement Planning

Retirement should be a time of peace, not financial struggle. We guide you in choosing the best retirement options, including tax-free growth accounts, ensuring your golden years are truly golden.

Business Strategies

Business owners must ensure their enterprises are financially strong and secure. We help structure comprehensive financial and insurance strategies that protect businesses, and their employees. By implementing sound financial planning, we equip entrepreneurs with the tools needed to sustain their businesses for generations, ensuring financial stability even in times of crisis.

Smart College Funding

Give your children the gift of education without the burden of debt. Learn how to build a tax-advantaged college fund that grows over time, ensuring your child’s future is financially secure without compromising your current lifestyle.

Tax-Free Wealth Accumulation

Why pay more in taxes when you don’t have to? Discover strategies that allow your money to grow tax-free, keeping more of your hard-earned wealth working for you and your family.

Lawsuit & Bankruptcy Protection

Financial risks can come unexpectedly. Learn how to legally and ethically protect yourself from lawsuits and bankruptcy, ensuring that your financial foundation remains unshaken.

Estate & Asset Protection

Shield your hard-earned wealth from economic downturns, legal threats, and market instability.

Require further clarification in matters pertaining to your finances?

Struggling to locate the information you seek? Let’s engage in a discussion.

Building Wealth, Protecting Legacies, and Honoring Your Family.

✓ Knowledge

✓ purpose

✓ legacy

Why Choose ARMCOR SOLUTIONS?

✅ 1. College Funding

- Secure your child’s education without student loan debt

- Grow savings tax-free & market-protected

- Flexible options for future financial use

✅ 2. Retirement Planning

- Build a secure, risk-free retirement income

- Maximize savings with tax-advantaged growth

- Never outlive your money

✅ 3. Tax-Free Growth Strategies

- Accumulate wealth without tax burdens

- Utilize compounding growth strategies

- Keep more of your hard-earned money

✅ 4. Asset & Wealth Protection

- Shield finances from market downturns

- Ensure wealth transfers generationally

- Protect your financial future

✅ 5. Lawsuit & Bankruptcy Protection

- Legal strategies to safeguard assets

- Keep wealth safe from unexpected financial threats

Client Testimonials

© All Rights Reserved.

ARMCOR SOLUTIONS Where Financial Clarity Meets Long-Term Security. is proudly powered by WordPress